A job well done always creates value for you

What is Value Creation

In its broadest sense, Value is doing good for or improving the wellbeing or worth of someone or something. Through work you improve your own wellbeing and that of others, and you thus create value for yourself and others

What is Work

Work has evolved and has remained an essential need for human beings. Indeed, work is necessary for survival of people, both for mental needs and for physical and material things. Mental needs include: to give challenges, to avoid boredom etc. Material things include those for sustaining physical life.

RI.gov says “Work gives individuals a sense of purpose and self-worth. For many, it defines who we are and is a source of justifiable pride. Work helps improve individual and family finances, and it helps us connect socially.”

Cparc.org says “Work is an important part of people’s lives. It means more than just getting paid. It means being able to make your own choices about how you want to live your life. At work, it’s what people can do that matters.”

Mark Ragland says

1. Work Teaches Responsibility

2. Work Connects People

3. Work Produces Endurance

4. Work Increases Self-Esteem

5. Work Gives You Money!

6. Work Offers Daily Impact

7. Work Challenges Comfort Zones

8. Work is NOT About You

9. Work Improves Society

10. Work Allows Independence

Ragland quotes his sister who said, “The world isn’t a scary place for me, I know how to work, budget, and interact with people”.

Work gives joy to some people. They just enjoy their work. For others work is priority number 1. They seem to have a work ethic. Indeed.com says “Work ethic is a trait that most employers look for right away in an employee. Your ability to work hard, overcome challenges and offer support to your colleagues demonstrates a strong work ethic and can help you be successful while building positive relationships.”

Sometimes work can be a drag…studying for an exam or giving one, doing routine work, doing work one does not enjoy are examples.

Work can be necessary or relevant. The most useful is necessary and relevant work. The most useless is unnecessary and irrelevant work, and very often we practice it, and companies do so unknowingly. In between is necessary and irrelevant work or unnecessary and relevant work. See my paper at the end of this one called Redesign work to Create Value, where I say work is value

Work is co-created and is two-way: The worker and the company are truly an example of two-way value creation, really what we would call co-creation

Workers and companies: The company provides an environment and an opportunity to work, for feeling useful, for fulfilment, for knowledge and experience gain, for growth, and hopefully improving wellbeing, for making money, and earning a living.

The employee gives back his knowledge, experience, his application to problem solving and innovation, for growth and wellbeing of the company. The employee gives dedication for about 8 hours plus or minus a day.

As employee creates value for the company, he creates value for himself. In return, the company creates value for employees, and it can retain substantial value (both economic and non-economic, for example building a reputation, or a knowledge base).

There is a contractual relationship between a company and work. If reduced to only this, there may be a brake on value creation.

Is work locational: Work is everywhere, at work (locational), or at home, or in society. Today the concept of remote work which can lead to a culture of geographical diversity and inclusivity.

Work life balance: Much is said about this, but this balance is in the minds of the worker, and those that expect a balance or part of the workers time away from work. One can ask if vacations are work, or watching TV work?

Feeling useless without work

As you grow older or are retired, sometimes you crave work just to keep you busy, motivated and occupied. Work gave you companionship, maybe a sense of camaraderie, and prevents boredom. Work made you feel useful.

Often in the absence of work, one starts to feel useless and craves work. This is a danger for people forced out of their jobs or during retirement.

Is work for payment or for creating value?

It is for both, depending on the situation. Sometimes it is for pure joy, sometimes it is for dissemination of knowledge (like for a teacher) or assimilation of knowledge, or doing something for someone or a company.

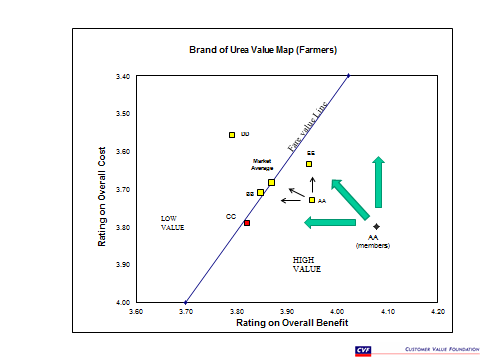

The company creates value for the employee (let us say A), and has a perception of the value it creates (A). The employee receives this value and perceives it differently (let’s say as B). At the same time the employee creates value for the company which he perceives as C. The company receives this value and perceives it as D.

The net value the company produces is A-D. The net value the company receives is D-A

The net value the employee receives less what he gives is B-C. The value he creates for the company is C-B

If company receives more value from the employee, then employee is profitable and valuable. This is in a sense the profit or value the employee makes for the company.

The evolution has been such that work is important. We need to look at the future to see how we can change all this. Alejandro Fontana in his article Professional Work and Value Creation https://www.exaudi.org/professional-work-and-value-creation/ suggests there will be human extinction without work. I am not that pessimistic, unless there is a takeover by aliens or by robots/AI. He also suggests work of one person influences and helps the existence of others. A power plant worker or a farmer helps others to exist gainfully. He suggests “There is a close correspondence between the conditions of nature and this capacity of man to work. If nature were chaotic, the ability to reason, to understand reality and to generate man’s tools would have no meaning.”

I wonder what will happen when jobs are taken over by robots, then the available time has to be used gainfully (as traditional work is lost) and such time will have to be spent for entertainment or new type of work. This is something older people start to see as they retire or become incapable of physical labour or time-consuming jobs and that is how to fill up their life meaningfully.

Alejandro Fontana says the greatest value of a job well done always remains within you; and sooner or later, it will also be recognized economically. When you work well, the value generated is very high. Part of that value is delivered to the consumer, but a large part – the majority – remains with oneself.

Read this article with my 2019 article below:

Redesign work to Create Value

Work is value!

By Gautam Mahajan in 2019

You don’t get paid for the hour. You get paid for the value you bring to the hour.

Jim Rohn

Value, Not Work should be our motto.

In its article, ‘In pursuit of value—not work,’ McKinsey asked, how valuable is your work. They later defined value as being commercial market value. They state work creates market value.

Unfortunately, the article misses what value is all about, how true value is very important, not just market value. They lose track of the definition of work. True value increases market value.

Work cannot be measured as output alone. it is more than that. It has to be measured as the impact and the real value which is benefits the receiver sees versus the costs (which includes price and non-price). The benefits the receiver sees is not just monetary.

You may design work to educate your employees. Then the immediate cash inflow from this training is nil and there is a net outflow and so by McKinsey’s definition it is not valuable work.

What if you do things a particular way and down the line you realise it is the wrong way of doing things and you have to redesign your effort. According to the definition of Mckinsey it is useless or wasted value. What you learnt might have given you superior knowledge and a leg up over competition, but that has no value according to the article. It may, on the contrary be extremely valuable.

Or if you set out to deliberately mislead competition by doing work that may make them follow your lead, or may make them think you are not a competitor. I worked for a company developing acrylonitrile beverage bottles (the only company in the business was Monsanto). Our company started work on PET secretly but publicly remained in acrylonitrile work. This caused others to take acrylonitrile seriously, an approach we were abandoning.

We define creating value as:

Creating Value is executing normal, conscious, inspired, and even imaginative actions that increase the overall good and well-being, and the worth of and for ideas, goods, services, people or institutions including society, and all stakeholders (like employees, customers, partners, shareholders and society), and value waiting to happen.

So according to this definition, we increased the overall good for our company and therefore created value.

Of course, each company must rethink work, abandoning routine tasks to machines and re utilising people for greater value creating work. Much has to do with creating more value for customers, employees and other stakeholders. This implies we look at hitherto supposed cost centres such as sustainability and convert them to create value for the company and therefore profit centres. Remember, it is creating value we are after not just monetary profit. This implies doing necessary and relevant work on sustainability that our customers and stakeholders such as governments can relate to and give us brownie points or create value for us instead.

Here is a definition of such work:

Necessary work is essential for, vital to, indispensable to, important to, crucial to, needed by, compulsory required by or requisite for the Customer or stakeholder

Relevant work is pertinent to, applicable or germane to, or appropriate to the Customer or stakeholder. This is work that can be eliminated without material deterioration of present service or product

What work is the Customer/stakeholder willing to pay for or considers creates value for him/her? That would be termed as Necessary and Relevant.

The mindset of workers and executives must go beyond just performing their jobs to consciously creating value. This is one valuable way of improving work.

Mckinsey in an article “Defining the skills citizens will need in the future world of work” has said, and I quote:

• add value beyond what can be done by automated systems and intelligent machines

• operate in a digital environment

• continually adapt to new ways of working and new occupations

While I agree these are necessary, I feel Mckinsey has defined the skills too narrowly in terms of the future of work and life. First and foremost, the skill needed is not just adding value, but creating value to be able to manage and address the future of ourselves, our lives, our way of life (or what is left of it in the changing environment) our work, to think of rewards and risks of AI.

- We need to teach executives and workers the meaning of value and how they can add value to their work, their workplace and themselves

- Workers and executives must create value consciously, and understand that performance is not enough

Leaders must

- ensure values and human values are incorporated; establish controls and checks for human intervention and override and supervision

- Make their executives understand that value is created not only by their direct tasks, but by their ideas, their thought process to create value in seemingly unconnected subjects like the environment or thinking about the product complaints and reaching zero complaints. Create value and ensure that the environment is managed and designed for the betterment of life, and not just for efficiency and for giving up our control because AI can do it better

- Be continually adaptive to create continuing value

- Become multi-disciplinary and multi-aware

These might sound trite, but the lure of technology is to do more with less, and that seems to be what technologists endeavour becoming eventually the human thought process is lost. We cannot allow this.

Ejaz Ghani thinking of India is 2030 says there will be a rise of the middle class and there will be a demographic dividend; India will be part of the global talent race; an urban awakening; India will be close to the largest digital economy; with a changing face of globalisation. There will be green growth and gender will be a growth driver. The problem is managing the transition.

So, we need to re-skill and re-teach to manage the future and do so by creating value. Digital democratisation will make people more equal You must have the right mindset. Creating value is a mindset that can set you ahead and design smartly. Cross disciplinary thinking becomes imperative. Now you are on the path to create valuable work, and to think work is value, and make work valuable.

Best,

Gautam Mahajan, President, Customer Value Foundation

Founder Editor, Journal of Creating Value jcv.sagepub.com

New Delhi 110065 +91 98100 60368

mahajan@customervaluefoundation.com

http://www.customervaluefoundation.com

Twitter @ValueCreationJ

Blogs: https://customervaluefoundation.wordpress.com/

Author of Value Creation, Total Customer Value Management, Customer Value Investment, How Creating Customer Value Makes you a Great Executive, The Value Imperative, Value Dominant Logic, Customer Value Starvation can Kill

The 6th Global Conference on Creating Value

Join the Creating Value Alliance at creatingvalue.co